Core Idea In One Line

Post Office Monthly Income Scheme: converts a one-time deposit into a predictable monthly cash flow that lands in your account like clockwork, without stock-market drama.

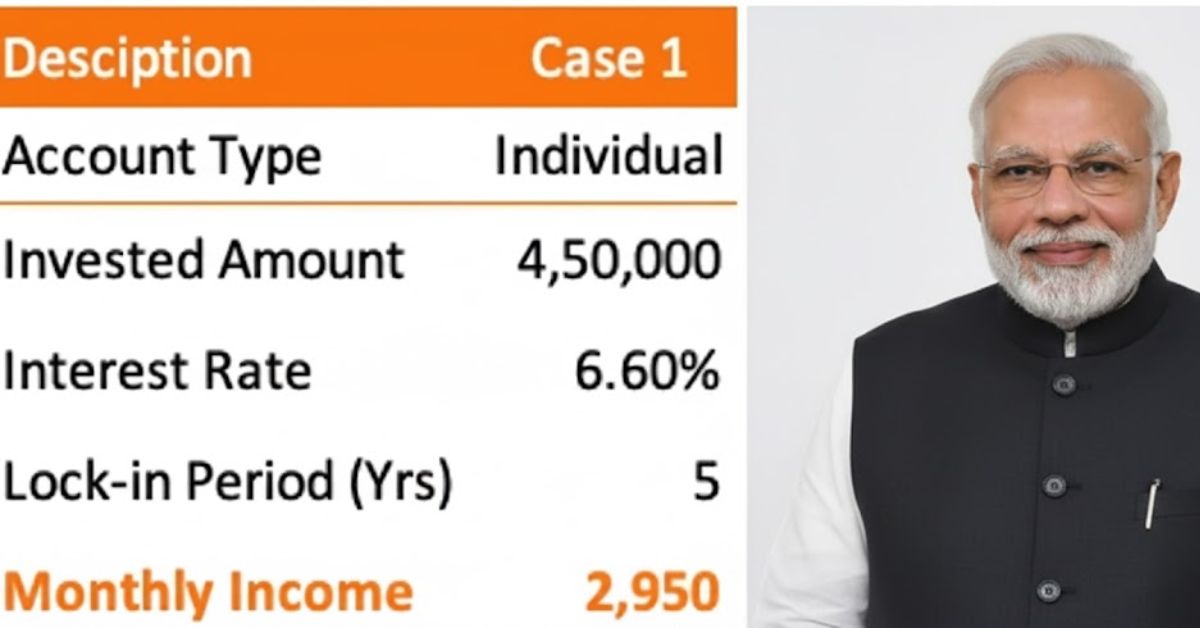

| Key Snapshot | Details |

|---|---|

| Scheme | Post Office Monthly Income Scheme (POMIS) |

| Payout | Fixed interest credited monthly to your savings account |

| Tenure | 5 years with premature-closure provisions as per rules |

| Minimum Deposit | ₹1,000 in multiples of ₹1,000 |

| Maximum Deposit | ₹9,00,000 for a single account; ₹15,00,000 for a joint account (up to three adults) |

| Safety | Government-backed small savings, steady administered rates |

| Ideal For | Retirees, homemakers, side-income seekers, low-risk investors |

Why The Post Office Monthly Income Scheme Still Wins Hearts

There’s a reason every town still has people who swear by the Post Office Monthly Income scheme. It is simple, transparent and designed for stability. You put in a lump sum once, and every month you receive interest as income. There are no confusing market-linked bonuses, no opportunity to “miss a cycle,” and no surprise fees appearing out of nowhere. The Post Office Monthly Income approach is about peace of mind: the money you depend on should be the money you actually receive, on time, every month.

How To Get ₹5000 Every Month: The Math In Plain Words

Monthly interest is calculated on your principal using the government-notified annual rate, and then paid out every month. To estimate how much you must invest for a ₹5000 monthly payout, use a simple thumb rule. Multiply your target monthly income by 12 to get annual income, then divide by the annual interest rate expressed as a decimal. If you want ₹5000 per month, your annual income target is ₹60,000. Divide ₹60,000 by the current annual rate to get the principal you need. As an illustration, if the rate is around 7.4% per annum, the required principal is roughly ₹8,10,811, and if the rate is around 7.1%, the requirement moves closer to ₹8,45,070. These are examples to show how the Post Office Monthly Income math works; the exact figure depends on the prevailing official rate on the date you invest.

The Logic Behind The Tenure And Why It Helps

The Post Office Monthly Income scheme runs for a fixed five-year tenure. This structure gives you long enough to enjoy a stable monthly cash stream, yet short enough that you’re not locked away for a decade. At maturity, you receive your original principal back. If your plans change midway, there are premature-closure rules with modest deductions depending on how far you are into the tenure. The balance the scheme strikes—monthly income now, principal safety for later—makes Post Office Monthly Income a dependable anchor for conservative portfolios.

Who Should Consider This Scheme First

If you rely on monthly cash flows to manage household expenses, EMIs, or medical costs, the Post Office Monthly Income scheme is built for you. Retirees often like the predictability. Homemakers and freelancers find comfort in a month-to-month income cushion. Parents saving for near-term goals appreciate the steadiness. Small business owners who want a portion of their profits parked in a safe, income-spinning corner also lean on Post Office Monthly Income to smooth out cash cycles.

Single Or Joint: Picking The Right Account Type

You can open a single account to keep things tidy under one name. If you want a higher deposit limit and joint access, you can open a joint account with up to three adults. The joint route raises the overall cap and keeps the Post Office Monthly Income discipline within a family unit, which is handy when spouses or siblings coordinate monthly budgets together.

A Day In The Life Of Your Money After You Invest

Once you invest in Post Office Monthly Income, the post office records your deposit and links your payout to your savings account. Every month, the interest is credited automatically. You don’t need to make manual requests or remember due dates. If you prefer, you can also keep the funds within your post office ecosystem and use them later to open or top up other small savings instruments when the five-year term ends.

How To Build A ₹5000 Income Stream Using Rate Bands

Because official interest rates can be revised, smart investors plan with rate bands. If rates drift lower, your required principal rises; if rates move higher, your principal requirement drops. For a target of ₹5000 per month, think in three lanes. In a higher-rate environment near the upper 7s, you could be around eight lakh of principal. In a mid-7s environment, you may be near eight-and-a-quarter lakh. If rates soften toward the low 7s, the figure can climb towards eight-and-a-half lakh. Anchoring your plan to these bands ensures your Post Office Monthly Income target remains realistic even when the cycle shifts.

Taxes: What You Should Know Before You Begin

Interest from Post Office Monthly Income is fully taxable as per your slab in the year you receive it. There is no section-80C deduction for the interest portion. The principal you get back at maturity is not taxed because it’s your own money being returned. If you are in a higher tax slab, factor in post-tax income when deciding the principal. Some investors pair Post Office Monthly Income with tax-efficient instruments for the long term while enjoying the monthly comfort from this scheme.

Managing Liquidity And Emergencies The Right Way

Life happens. The Post Office Monthly Income scheme allows premature closure with a small deduction, usually after a minimum lock-in period. While the idea is to let your deposit run the full five years, the ability to exit offers emotional and financial comfort. Many families also keep three to six months of expenses in a separate emergency fund, so their Post Office Monthly Income remains undisturbed and keeps doing its quiet job.

Why Many Investors Prefer POMIS Over Bank Recurring Deposits

Recurring deposits force you to invest monthly to build a future lump sum; Post Office Monthly Income flips the idea and pays you monthly from day one. If your priority is a steady payout starting immediately, Post Office Monthly Income has the edge. Bank fixed deposits can also pay monthly interest, but POMIS appeals to investors who like the government-backed small-savings ecosystem and the post office’s wide reach, especially outside big cities.

Setting The Right Expectation About Returns

The Post Office Monthly Income scheme is not trying to beat equity funds or aggressive debt products. Its job is to deliver predictability, not thrill. If you compare it with inflation-beating market assets over long decades, it will look modest. But if you compare it with the need for a reliable monthly stipend that never misses a date, Post Office Monthly Income shines. The point is to use it as the “stable leg” of your stool, not the entire stool.

A Simple Example Plan For A Household

Imagine a household wants ₹12,000 per month of predictable inflow to cover groceries, utilities and transport. One spouse parks a portion in Post Office Monthly Income to generate ₹5000 per month. Another uses a mix of fixed deposits and a conservative short-term debt fund for the remaining ₹7000. Together, they create a layered cash flow plan that keeps the kitchen running while leaving market-linked investments to chase growth separately. This is how Post Office Monthly Income works best—in harmony with other instruments.

How To Open And Operate Without Stress

Visit your nearest post office with KYC documents and a passport-size photograph. Decide whether you want a single or joint account. Fill the form, choose the deposit amount in multiples of ₹1,000, and link your post office savings account or bank account for monthly credit. Once processed, your Post Office Monthly Income account starts its five-year clock, and your first monthly interest credit will arrive the following month. There’s very little maintenance required after that.

What Happens At Maturity And How To Reinvest Smartly

At the end of five years, your Post Office Monthly Income account matures. You can withdraw the principal or roll it into another instrument based on interest-rate conditions at that time. Many investors time maturity proceeds into schemes like Senior Citizens Savings Scheme if they become eligible, or they renew Post Office Monthly Income itself to keep the monthly cash flow going. The trick is to look at prevailing rates near maturity and decide whether to stick, step up, or switch.

Risk, Or The Lack Of It, In Everyday Language

Market risk is minimal because the Post Office Monthly Income rate is administered and reviewed by the authorities. Interest-rate risk exists in the sense that future rates for new accounts may move up or down, but once you lock your deposit, your rate is set for your five-year term. Liquidity risk is moderate due to premature-closure rules, but still manageable. Credit risk is low because the scheme is government-backed. In short, Post Office Monthly Income is engineered for capital protection and monthly certainty.

Fine Print That Actually Matters

Keep your nomination updated so family can access the account smoothly if needed. Track your savings-account details to avoid failed credits. If you plan to close the account early, check the deduction slab applicable at that time so you aren’t surprised. If you want to target a specific monthly figure like ₹5000, build a small buffer in your principal to offset rate moves by the time you actually deposit. These small steps keep your Post Office Monthly Income experience stress-free.

A Quick Ready-Reckoner For ₹5000 Per Month Targets

If you’re reading this with a calculator in hand, here’s a ready way to think. Take ₹60,000 as your annual income target. If the official rate at your time of investment sits near the mid-7s, your principal will likely be a little over eight lakh. If rates are closer to the low-7s, plan for eight-and-a-half lakh. If rates surprise on the higher side, the principal requirement shrinks. This simple ready-reckoner lets you prepare funds in advance and open your Post Office Monthly Income account the day you see a comfortable rate.

The Bottom Line For Peace-Seeking Investors

If you want your money to show up monthly without fuss, the Post Office Monthly Income scheme is one of the cleanest ways to get it done. It won’t make headlines for double-digit returns, but it will make your monthly budget feel calm and predictable. Combine Post Office Monthly Income with your growth-oriented investments, and you’ll have a portfolio that sleeps well at night and still wakes up to progress.

FAQs On Post Office Monthly Income

How much should I deposit to earn ₹5000 every month from Post Office Monthly Income?

You first decide the monthly target and then compute the principal using the annual rate in force on your investment date. As a working example, for ₹5000 per month, the annual target is ₹60,000. Divide that by the prevailing annual rate (expressed as a decimal) to get the principal. Around the mid-7s, it typically comes out a little above eight lakh. Your exact figure depends on the official rate when you open the Post Office Monthly Income account.

Is the interest from Post Office Monthly Income tax-free?

No. The interest is fully taxable as per your income-tax slab in the year of receipt. The principal returned at maturity is not taxed. Plan the principal for your Post Office Monthly Income after considering post-tax cash flow.

Can I open more than one Post Office Monthly Income account?

Yes, you can open multiple accounts as long as the combined deposits stay within the maximum limit for the relevant category—single or joint. Many families build multiple Post Office Monthly Income accounts with different maturity dates to stagger cash flows.

What happens if I need the money before five years?

The Post Office Monthly Income scheme allows premature closure after a minimum period, with a small deduction depending on how long the account has run. If you think you may need liquidity, keep some of your corpus outside in an emergency fund so your Post Office Monthly Income deposit can stay intact.

Is Post Office Monthly Income better than a bank fixed deposit?

They serve similar purposes but with different comforts. Bank FDs can also pay monthly interest, but Post Office Monthly Income appeals to investors who prefer the government-backed small-savings framework and the post office’s presence across India. Rate decisions and convenience features will guide your final choice.

Final Take

The Post Office Monthly Income scheme is not flashy, but it is faithful. It gives you a predictable monthly amount, protects your principal for five years, and keeps paperwork and maintenance to a minimum. For anyone who wants a calm, reliable cash stream—whether that’s ₹5000 a month or more—the Post Office Monthly Income route is a time-tested answer that keeps your financial life steady and your mind clear.